ebike tax credit status

Electric Bicycle Incentive Kickstart for the Environment Act or the E-BIKE Act. A 30 percent tax credit for new e-bike purchases made it into the White Houses Build Back Better legislation as the 175 trillion budget deal nears the.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22379746/Specialized_VadoSL.jpg)

Tesla S Co Founder Is Teaming Up With Specialized To Solve The Problem Of E Bike Batteries The Verge

Sharon Shewmake D-Bellingham who introduced the bill called it a bipartisan bill that.

. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles. That means there are other bills with the number HR. Of course a more realistic and common ebike price of 3000 could mean a tax credit of 900and a 2000 ebike might get you a 600 30 credit.

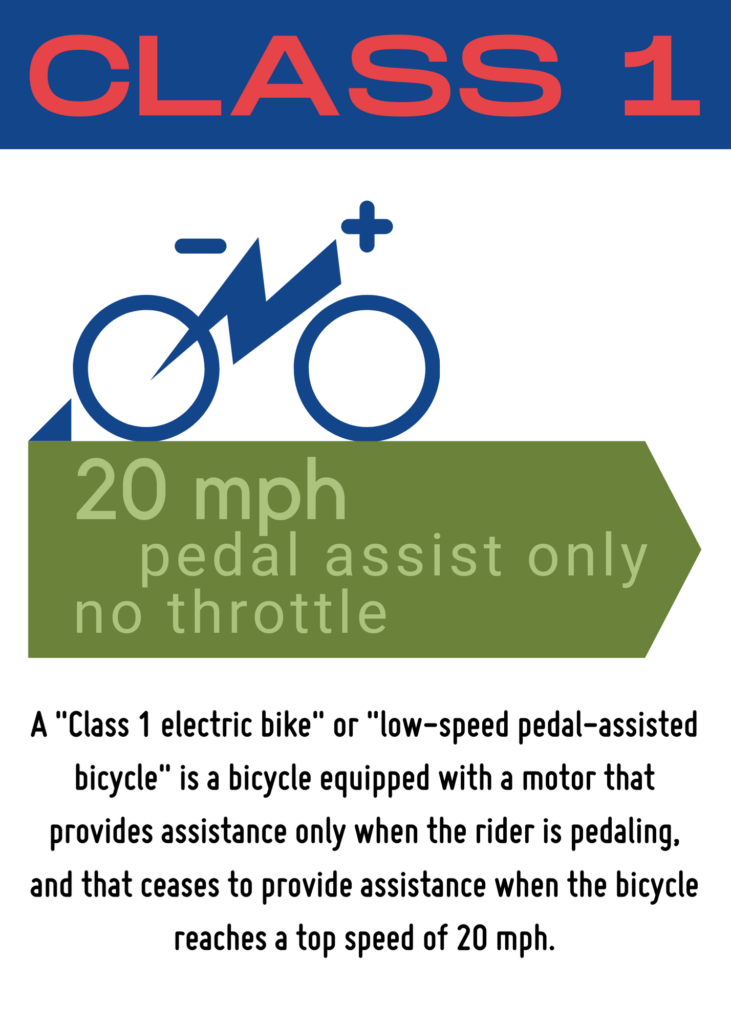

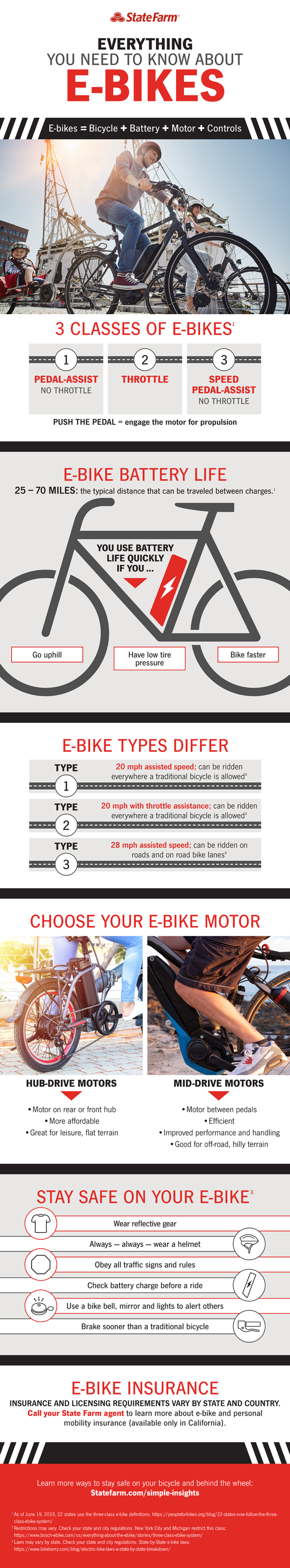

Class 1 2 and 3 electric bikes of a value of up to 8000 qualify for the credit. Cars need to be under 55000. 1019 is a bill in the United States Congress.

This is the one from the 117 th Congress. It phases out. This credit amount would be doubled in the case of a joint tax return where two family members purchased eBikes.

Joint filers who make up to 150000 can qualify for two bikes and up to a 900 tax credit on each. Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. The Electric Bicycle Incentive Kickstart for the Environment Act creates a consumer tax credit that can cover up to 30 of the cost of buying an eBike.

The credit would be available to. Joint filers who make up to 150000 can qualify for two bikes and up to a 900 tax credit on each. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25.

The proposed eligibility requirements for the EV tax credit are simple. The Houses latest vote on. The credit is limited to 1500 per taxpayer less all credits allowed for the two preceding taxable years.

If you want to get a tax credit for your electric bike you can claim a 30 percent credit over five years for up to 3000 on a new bike which is a. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Beginning in 2022 taxpayers may claim a credit of up to 1500 for electric bicycles placed into service by the taxpayer for use within the United States.

Bills numbers restart every two years. This credit would be available to all e-bike purchasers regardless of socioeconomic status a common divider in tax credit bills. A Allowance of credit In the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount equal to 30 percent of the cost of any qualified electric bicycle placed in service by the taxpayer during such taxable year.

A Class 1 2 or 3 e-bike purchase qualifies for the credit. 500000 for married couples. Individuals who make 75000 or less qualify for the maximum credit of up to 900.

This means you can buy an electric bike costing as much as 5000 or more to get the full 1500 credit. This bill allows a refundable tax credit for 30 of the cost of a qualified electric bicycle. In a tweet Rep.

This tax credit would be wonderful news to avid e-bikers and new riders alike. Theres also an income limit for taxpayers to receive the credit. For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus an additional 417 for each kilowatt hour of.

A bill must be passed by both the House and Senate in identical form and then be signed by the President to become law. The credit has a limit of 1500 or 30 of the total cost whichever is less. The Electric Bicycle Incentive Kickstart for the Environment E-BIKE Act S.

Non-cars vans trucks SUVs need to be under 80000 to be eligible for the credit. Sharon Shewmake D-Bellingham On Tuesday by a 57 to 39 vote the Washington House of Representatives passed HB 1330 exempting electric bikes and up to 200 in bike accessories from state sales taxes. The maximum price of the e-bike must be 8000 or less.

As stated you might get up to a 1500 credit to defray 30 of the cost of an electric bike. Brian Schatz D-Hawaii and Ed Markey D-Mass. The law has not yet been passed as of August 2021 but if approved it would allow 30 with a total limit up to 1500 to be refunded per taxpayer on the purchase of an e-bike.

Much like the House bill Schatz and Markeys legislation would offer Americans a refundable tax credit worth 30 percent of a new e-bikes purchase price capped at 1500. The credit was restored to 30 percent. Electric motorcycles already receive a 10 federal tax credit but that figure was tripled to 30 in the new bill according to the Washington Post.

This is not a motorcycle this is an e-bike. 2420 was authored by Sens. Posted on March 11 2021 by Ryan Packer.

The bill now goes to the Senate. WASHINGTON BRAIN The House of Representatives on Friday morning approved the Build Back Better Act that provides billions of dollars in funding for an e-bike tax credit bike commuter benefit and climate and equity-enhancing infrastructure as part of the 175 trillion social spending bill. 250000 for single people.

The credit was capped at a maximum of 7500. Where the E-BIKE Act Stands Currently the House version E-BIKE electric bicycle tax credit initiative has 21 co-sponsors all. A taxpayer may claim the credit for one.

Senators introduce e-bike tax credit bill. The E-BIKE Act creates a credit against your federal taxes of up to 1500 per taxpayer. This tax credit is an essential step toward recognizing e-bikes as a crucial green transportation option.

B Limitation. The E-Bike Act would create a federal tax credit equal to 30 of the purchase price of electric bikes up to a maximum credit of 1500. WASHINGTON BRAIN An e-bike tax credit bill similar to the one created in the House in February was introduced into the Senate last week.

A qualified electric bicycle is a two-wheeled vehicle that is among other things equipped with an. As part of Bidens Build Back Better bill individuals who make 75000 or less qualify for the maximum credit of up to 900. The credit can go toward purchasing one new e-bike with a price tag of 8000 or less.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19866675/1208040894.jpg.jpg)

New York Finally Legalizes Electric Bikes And Scooters The Verge

Aventon Aventure Electric Bike Cleantechnica Review In 2022 Electric Bike Electric Cargo Bike Bike

Schwinn Ec1 Electric Cruiser Style Bicycle 26 Inch Wheels 7 Speeds Blue Walmart Com Best Electric Bikes Schwinn Electric Bike

High Demand For E Bikes Could Be Pushed By Tax Break

Ebike Classifications And Laws San Diego County Bicycle Coalition

Understanding The Electric Bike Tax Credit

High Demand For E Bikes Could Be Pushed By Tax Break

New E Bike Act Introduces 30 Us Federal Tax Credit For Electric Bicycle Purchases Electrek In 2021 Folding Electric Bike Electric Bike Electric Bicycle

4 Ways To Get Financial Help To Buy An E Bike Calbike

E Bike Lending Libraries Aim To Boost Adoption Bloomberg

New E Bike Act Introduces 30 Us Federal Tax Credit For Electric Bicycle Purchases Electric Bicycle Bicycle Ebike

What Are E Bikes How To Stay Safe And Covered State Farm

Understanding E Bike Classifications Laws And Regulations Juiced Bikes

Review The New 2020 Gocycle Gx Is An Awesome E Bike If You Ve Got The Cash Https T Co Ufl46o3kv4 By Micahtoll Bjmt Ebike Bike Folding Electric Bike

Wing Launches New Freedom X A Stylish E Bike At A More Budget Friendly Price Bike Ebike New Freedom

Red Electric Urban Bicycle Electric Bike Best Electric Bikes Electric Mountain Bike

/cdn.vox-cdn.com/uploads/chorus_image/image/68867294/1212203103.0.jpg)

E Bikes Are Expensive But This Congressman Wants To Make Them More Affordable The Verge